XX. Cyprus-Troika Memorandums of Agreement

There are three key document that were leaked by the FT and Reuters.Final versions of these were posted on the Dutch Finance Ministry website in late April - links thanks to the FT's Brussels Blog. (These are now updated).

See also this very useful IMF Country Report on Cyprus May 2013 that includes Mof U Technical M of U, staff asessments and detailed economic analysis.

The Memoraundum of Understanding (provisional draft 9 April 2013) (draft here). Updated 29 April)

The ESM’s “Proposal for a financial assistance facility agreement for the Republic of Cyprus” (which is posted here).

The “debt sustainability analysis” (posted here).Updated 29 April)

And important Note to this 'Assessment of the actual or potential financing needs of Cyprus' (posted here) (Updated 29 April).

There is also an “ESM proposal for terms of the first Tranche under the FFA for Cyprus” (posted here).

See this excellent page of Cyprus Bailout documents at Cyprus.com

The Final Programme figures

Here are what are supposed to be the final figures for the Cyprus bailout pgoramme. These rose dramatically between the first draft of the Assessment of Financial Needs of 25th March and the 9th April version. The total programme figure increased from €18 to €24bn.

These figures were not strictly comparable as came to light through Ollie Rehn's comments about comparing apples, pears and organges (see previous blogs below).

The final 12th April gross programme figure is now €21.5bn against the original of March 25th of €18bn. This is still a marked increase and reflects the rapidly deteriorating economic situation in part created by the bungled bailout.

The major difference in the April 9th and 12th positions was accounted for by the reduced estimate of bail-in needs from depositors at Laiki and Bank of Cyprus (for more detail of changes see the notes under the table and Peter Spiegel's Brussels Blog in the FT that brought the 'final' figures to light).

There are still inconsistencies in the 'final' Financial Needs Assessment' document.

For example, the bank bail-in figure in the text of the document is given as €8.3bn but in the detailed table in Annex 1 the 'Debt-equity-swap' figure is given as €10.3bn.

Spiegel reports that in a walk-through of the figures above with an EU official it became apparent that initial confusion arose because the bank bond default imposed on junior bondholders was not included in the initial programme figures.

Burden sharing revisited

It should of course be noted that with with these revised figures the burden sharing between the EU/IMF and Cyprus has changed to Cyprus's disadvantage both absolutely and relatively. The total amount of the programme carried by Cyprus has risen from €8bn in late March 2013 to €11.4bn in early April 2013 and the percentage of the programme carried by Cyprus has risen from 44.4% to 53%. The EU/IMF programme share amount has remained constant at €10bn while the percentage of the pgoramme this carries has fallen from 55.6% to 47%.

Links to the final versions of the documents posted on the Dutch Finance Ministry website can be found here (Memorandum) at top of page.

Table 1: Cyprus bailout programme finance needs from the Assessment of Financing Needs Document

|

€bn |

ESM/IMF |

Cyprus March 25th |

Cyprus April 9 |

Cyprus April 12 |

|

Bank Recapitalisation |

2.5 |

5.8 |

10.6 |

8.3 |

|

Increased Taxes |

|

1.0 |

0.6 |

0 |

|

Gold Sales |

|

|

0.4 |

0.4 |

|

Debt rollover |

|

|

1.0 |

1.0 |

|

Privatisations to 2018 |

|

|

1.4 |

0.5 |

|

Default on bank bonds |

|

1.2 |

|

1.2 |

|

Restructuring Russian Fed debt |

|

|

0.1 |

0.1 |

|

Medium-Long Term Debt |

4.1 |

|

|

|

|

Fiscal Needs |

3.4 |

|

|

|

|

Programme Total (gross) |

|

18 |

24.1 |

21.5 |

|

Burden Sharing (CY amount) |

|

8 |

- |

11.4 |

|

Burden Sharing (CY % total) |

|

44.4% |

- |

53% |

|

|

|

|

|

|

Notes to Table 1 above

The April 12 total is exaggerated because privatisations includes receipts that will be received after the programme period.

The default on bank bonds was never included in the Assessment of Financial Needs document but it has been counted by EU officials as part of the programme gross cost.

The April 12 version of the Assessment of Financial Needs makes no mention of increased taxes that figures in the original and April 9th versions of the document - why?

My programme total of €21.5 differs from Peter Spiegel's total of €21.4 in his blog link above because I have included the 'Restructuring Reussian Debt' figure - that appears in the text but not in Annex 1. Note 3 in the text is ambiguous.

The bank bailout figure for Laiki/BofC has been reduced from €10.6 to €8.3bn due to reworking estimates of the financing needs of the banks.

The April 12 figure is still €3.4 or 3.5bn above the original estimates of the programme cost.

Proposal for a financial assistance facility agreement for the Republic of Cyprus

Health warning: This is not a blow-by-blow precis but more about the bits that's particularly interested me.

Downsize and restructure to reduce size of banking sector to 350% GDP. Much achieved already with 'carve-out' of Greek operations.

Money laundering: Supervision will be reinforced and anti-money laundering (AML) framework willbe strengthened in line with best practice and theimplementation of AML standards ensured.

Fiscal Consolidation to reduce public debt to GDP

[127%] in 2015, reaching around [120%] of GDP at the end of the programme in 2016 and decline to [102%] by 2020.

Loan Agreement

€10bn to be loaned to Cyprus. Nine from European Stability Mechanism and one billion from IMF.

Charges

Cypurs to be charged margin of 10 basis points (0.1%) on laon over 15 min to 20 max year period.

Other charges:

- Up-front Service Fee of 50 bps (0.5%)upfront for every disbursement

- Annual Service Fee of 0.5 bps

- Commitment Fee (unspecified)

Compliance

Disbursements under the financial assistance facility agreement will be contingent on compliance with the detailed undertaking in the Memorandum of Agreement

Memorandum of Understanding on Specific Economic Policy Conditionality (provisional draft 9 April 2013) (pp. 34.)

Health warning: This is not a blow-by-blow precis but more about the bits that's particularly interested me. Having said that most is here. For existing 2013 Budget commitments see Annex 1 of the document.

Three broad objectives:

1. to restore the soundness of the Cypriot banking sector and rebuild depositors' and market confidence by thoroughly restructuring and downsizing financial institutions, strengthening supervision and addressing expected capital shortfalls;

2. to continue the on-going process of fiscal consolidation in order to correct the

excessive general government deficit... in particular through measures to

increase the efficiency of public spending ...enhance revenue collection and improve the functioning of the public sector;

3. to implement structural reforms to support competitiveness and sustainable and balanced growth ... in particular by reforming the wage indexation system and removing obstacles to the smooth functioning of services markets.

Banking/Finance Sector

Notes exposure to Greek debt but focuses on home-grown problems,

many of the sector's problems are home-grown and relate to overexpansion in the property market as a consequence of the poor risk management practices of banks.

Property has been a real issue compounded by.

the sensitivity of collateral valuations to property prices, and banks have used certain gaps in the supervisory framework to delay the recognition of loan losses, thus leading to significant under-provisioning.

Progress: banking assets-to-GDP already reduced from 550% GDP to 350% GDP.

Banking Actions

- Liquidity Maintain bank liquidity

- Loan Recovery Increase recovery of loan defaulters vis 'legislative framework currently constraining the seizure and sale of loan collateral will be amended such that the property pledged as collateral can be seized within a maximum time-span of 1.5 years'

- monitor non-performing loans over 90 days late

- create central creditor-checking register

- review of CBC loan supervision and the collateral value issue

- Supervision CBC unified data reporting to include supervision of cooperative banks and shift of regulatory control from Min of Commerce to CBC

- Private Debt better monitoring corporate and household indebtedness

- create framework for private-sector-debt restucturing

- Money laundering audit of anti-money laundering framework and entity transparency, establish trust register and evaluate Register of Companies

- Recapitalisation bank recap needs of €6-8.9bn (but recap needs exclude nearly 40% of cooperative banks that have not been stress-tested)

- 'Bank of Cyprus and Cyprus Popular Bank have been intervened and restructured'

- Greek operations 'carved-out' 'With the book value of the assets at EUR 19.2 billion, the carve-out has substantially reduced the cross exposures between Greece and Cyprus' (no mention of price Piraeus Bank paid for these assetts which was €524m)

- BofC and Laiki transfer of Laiki assetts to BofC as detailed elsewhere

- independent assessment of BofC and Laiki asetts to be carried out

- CBC to appoint BofC chief exec and board of directors until shareholders organised in an AGM

- ESM (European Stability Mechanism) for other banks other banks (not Laiki and BofC) can ask for recap assistance from the state (€2.5bn of ESM allocated to this?) but only after approval of restructuring plans under state-aid rules

- Coperative bank sector coop banks should seek private sector participation to minimise state aid

- restructuring plan for coop bank sector to be drawn up by CBC and submitted to EC, ECB and IMF for approval

- programme will make ESM funds for coop recap available

pp 4-11.

Fiscal Policy

- To meet targets agreed in 2013 budget

- Revenue Measures Corporate Income tax from 10 to 12.5%

- Tax on interest income to 30%

- Bank levy on depositis from 0.11 to 0.15%

- Review all car taxes and car fuel taxes to increase levy and bring in environmental principles

- Complete increase charge on public services to 17%

- Expenditure Measures control health expenditure

- reduce by €36m expendiiture on various housing schemes

- means test Easter pensioner allowance

- reduce emoluments to public and braoder public sector pensions

- reforms to teachers hours-in -ieu and other arrangements

- Fiscal Policy achieve a deficit of the general government primary balance of no more than EUR 678 million (4¼% of GDP) in 2014 (2.1%) 2015 and surplus of (1.2%) 2016

Fiscal-Structural Measures

- introduce Medium-Term Budgetary Framework (MTBF)

- pension reform - separate accounting for tax-financed non-contributory pensions and contributory pensions

- incease retirement age and pension ages [which is currently effectively 63]

- actuarial study of the General Social Insurance System with view to comprehensive reform

- Health care - reduce categories of free access

- introduce contributory scheme for public servants and public sector pensioners of 1.5% gross salary/pension

- increase medical fees for 'non-beneficiaries' by 30%

- plan restructure of services and thorough review of planned introduction of a National Health Service

- rejig health care worker hours across the calendar year

- Budgetary Framework - create a Fiscal Council

- Public Private Partnerships (PPPs) -not tender any public work 'until an adequate legal and institutional framework for PPPs designed according to best practices' is put in place [A thinly veiled anti-graft measure?]

- State owned enterprises (SOEs) and privatisation - establish an inventory of state and local government-owned assets,

- strenghten the governance and performance of SOEs

- draw up a privatisation plan of SOEs and semi-SOEs including telecomms, electricity, ports, to raise €1.4bn by 2018

- tax collection reform - measures include increasing individual legal liability of company personnel for unpaid taxes, instituting European directives on anti-VAT fraud, improving the capacity of the revenue service, increasing transparency of real ownership of companies and trusts registered in Cyprus

- Tax Information Exchange and Transparency 'Implement the recommendations put forward in the in-depth review of Cyprus's legal and regulatory framework under the OECD Global Forum on Transparency and Exchange of Information for Tax Purposes and commit to address any shortcomings to be identified in the forthcoming evaluation of implementation issues.'[tax haven issues?]

- Property Tax Improve and update property taxation based on current values

- Public Administration Reform - to rejig working hours and carry out an evaluation of staffing of public administration and remuneration systems

- Welfare system - to better target and streamline benefits and agree means-test definitions.

Labour Market Measures

- Labour Market - to reform wage-setting and the Cost of Living Adjustment wage indexation system -from six monthly to annual indexation

- to move from 100% to 50% wage indexation against cost of living increases

- Labour Market Reintegration - assisting the unempployed back to work by 'activating benefit recipients by facilitating their reinsertion in the labour market'

- Review of the practices of professions

Goods and Services

- improve the market clearing of property

- Create a thorough-going tourism strategy

- Energy services - formulate a comprehensive strategy for the rearrangement of the Cypriot energy sector

- Gas - a roll-out plan for the infrastructure required for the exploitation of natural gas and plan a regulatory and institutional framework.

Assessment of the public debt sustainability of Cyprus DG Economic Affairs Provisional Draft 9 April 2013

The Assessment of Debt Sustainability Cyprus (see above for link) is a broad economic analysis of the Cyprus economy's shift from growth pre-2009 to increasing crisis.

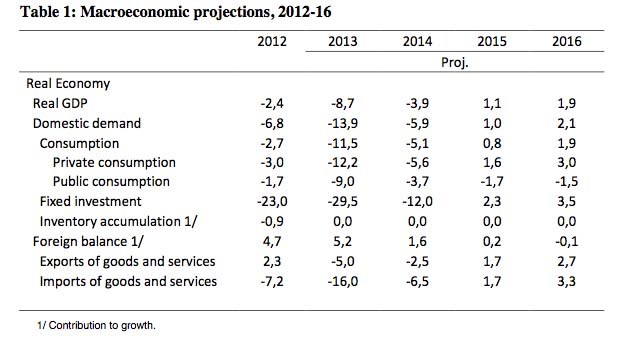

The most important part of the Assessment is the chart of economic forecasts - Table 1 - reproduced below and the assessment and allocation of funding needs.

In this GDP is forecast to fall by 15% between 2012 and 2014 before returning to moderate growth in 2015.

In the same period domestic demand is forecast to decrease by 26.6 per cent with a fall in private consumption of 18.8 per cent and a fall in public consumption of 14.4 per cent. Fixed investment in the same period is expected to crash by 64.5 per cent.

Imports are expected to fall by 29.7 per cent while exports fall 7.5 per cent.

The fiscal adjustment path, detailed in the Memorandum, aims to,

to achieve a continuous strengthening of the primary budget balance over the programme period, resulting in a primary surplus of 3% of GDP in 2017 and 4% of GDP in 2018, maintaining at least such a level thereafter (p. 6).

Background to Changes in Financial Needs Assessment changes

The Note on the 'Assessment of the actual or potential financing needs of Cyprus'sets out the total funding requirement of the programme period Q2-2013 - Q1-2016 as €23bn (see Memorandum).

As commentators have pointed out the total funding requirement for the programme seems to have grown from the 16 March 2015 bailout meeting total of €17bn with Cyprus contibuting €7bn (to be raised from the now-infamous bank levy - €5.8bn - and the rest from a new withholding tax on investment profits) to a total in the 25th March meeting of €23bn with Cyprus contributing €13bn.

In the 25th March meeting it was agreed to raise the total funding for the prgoramme from Cypriot bank bail-ins from €5.8bn to €10.6bn.

In other words, the cost to bank account holders to bail out Cyprus’ financial sector increased by nearly €5bn in nine days. That’s almost a third of the island’s entire economy (FT Spiegel Brussels Blog 10 April 2013).

The total figure in the above table for Cyprus is over €13bn because it includes privatisation receipts that are forecast to arrive after the end of the programme.

No explanation is given in the Note or DSA with regard to this increase in financing needs which caused astonishment and anger when the DSA document was leaked on 10th April 2013.

In effect the 'burden-sharing' in the second set of figures has resulted in no sharing at all - Cyprus's part of the burden (from €7bn to €13bn) rose by 57 per cent while the ESM/IMF burden stayed exacly the same. And its proportion of the share of the burden also rose from 53.8% to 56.5%.

The DSA lists downside and upside risks before concluding that,

Cyprus' debt outlook is challenging, but [the programme] will allow Cyprus’ public debt to remain on a sustainable path, provided that there is strong implementation of the adjustment programme (p. 15).

The presentation of these revised and provisional figures with no explanation seems an act of sheer folly by DG Economic Affairs.

How is the huge 35 per cent increase in the bailout/programme total in nine days to be explained?

The Cyprus Mail (13 April 2013) reported a press conference on 12 April 2013 where Ollie Rehn, EU Economic and Monetary Affairs Commissioner, is reported as saying that the two bailout/programme totals were 'not strictly comparable because the construction of the first and second, or final package, are different”.

As such he said that, "People have been comparing apples with pears and coming up with oranges."

He said that the €17.5bn earlier total, "is related to net financing needs, while the larger figure of €23.5 is a gross financing concept" which includes additional buffers to allow for weaker fiscal developments and additional costs in banks.

The blogger Tyler Durden at the Zero Hedge website suggeste that the increase between the two figures was due to,

an increase ... in the stealth outflow from banks [prior to the bailout that] was much worse (read bigger) than previously reported, leaving banks with a far bigger [recapitalisation] hole to plug (Zero Hedge 11 April 2013).

Another blog post at Zero Hedge, this time by the delightfully named Testosteronepit, (13 April 2013) gives a more detailed account. He, for I assume with a name like that it is a 'he', says that the new figures were met with outrage in the Cypriot parliament.

According to President of Parliament Yannakis Omirou, the Troika “served poison.” Giorgos Doulouka, spokesman of the opposition AKEL party declared, “We will resist,” adding, "They are eating us alive." [NB see my page Background for the resistance as 'delay tripled' carried out by the comrades at AKEL during their spell in power.]

In addition, three members of the governing council of the Central Bank resigned allegedly protesting to President Anastasiades that the council served only for “decorative” purposes.

What are we to make of all this?

It suggests firstly, that EC economists really have very little idea about the eventual size of the economic catastrophe Cyprus might suffer.

Ollie Rehn as much as admitted this,

Mr Rehn acknowledged the uncertainty created by the chaotic handling of the bailout and said it was almost impossible to know how hard the Cypriot economy would be hit.

“I don’t deny under the current circumstances there is some uncertainty on the exact figures,” Mr Rehn said.

Secondly, it suggests that EC officials are making up policy as they go along, in effect raising the percentage of bail-in losses to be imposed on depositors from one day to the next.

Thirdly, it suggests that those who are responsible for the drafting and presentation of these documents have little understanding of the importance of justifying and explaining them to a wide range of audiences (leaking was almost inevitable) - from Euro Finance Ministers, other EZ member states and not least the people of Cyprus who are both frightened and enraged by what they see as an arbitrary and unjustified increase in the level of the 'robbery' and 'expropriation' they are to suffer.

And fourthly, the self-effacing and football-loving Mr Rehn needs to realise that the increase in the price of the apples, pears and oranges that different people are counting are all going to be paid for the people of Cyprus and/or the uninsured depositors in the domestic operations of the Bank of Cyprus and the now shuttered Laiki Bank.

It is all very well to say that the new bigger €23bn figure is a 'gross financing concept' but the DSA and the 'Potential Funding Note' make no hint of this and from on high they allocate all the new costs to Cyprus in a macabre example of asymmetrical 'burden-sharing'.

Just when you thought the twice-bungled bailout could not get any worse...

Recalculating those figures

Peter Spiegel posted an excellent Brussels Blog April 17 2013 in on the FT online in the light of Ollie Rehn's pointing the finger at Spiegel for leaking the MofU and other ducments - see top of page. I liked the Spiegel tweet that in effect said, I can take the pressure. I used to be a war correspondent.

In the blog Spiegel re-examines the figures in the assessment of financing needs for Cyprus (we still await the release of the final documents which is surely a scandal given the uncertainty the headline figures, which 'are tossed about with abandon,' have caused).

Speigel concludes the blog with this,

As far as we can tell, the amount needed to fund the Cypriot government really hasn’t changed that much from pre-bailout to post-bailout estimates. Sure, the actual deficits have increased by €1.7bn, thanks to a darkening economic picture. And there’s an extra €400m needed to fill a pension hole, which was created when the pension fund lost its holdings in the now-shuttered Laiki bank.

But that is offset by deciding not to pay domestic holders of €1bn in government bonds. They will be “encouraged” to roll over their holdings instead. And they’re selling gold. And privatising government assets.

What has really changed are the needs of the Cypriot banks, which went from €10bn to €13.1bn. It is still a major increase, much of which is due to the botched handling of the first bailout. But it’s €3.1bn, not €6bn.

As far as I can see, this does not change the burden-sharing picture I painted above in that the increased burden is all carried by the two Cypriot banks and their depositors. However, it does reduce the increase in the burden on Cyprus between the pre-bailout and post-bailout versions of the ESM agreement.

Background to those bailout numbers - June 2012 EZ officals estimate €3bn bank bailout

It is interesting how the bailout numbers emanating from the euro zone have grown over time. Reuters reported back on 26 June 2012 Kamabas, when Cyprus made its first approach for a bailout, that,

Two euro zone officials said that a package of up to 10 billion euros was being considered for the 17.3 billion euro Cyrpriot economy.

One official is quoted saying,

"The exact number has not been decided yet. It was to be 6 billion for the state financing and 2 billion for the banks but that is optimistic - it is more likely to be seven and three - up to 10 billion euros in total."

The Exotix bank bailout estimates July 2012 - at €15bn

Shortly afterwards Gabriel Sterne (Exotix July 5 2012) was estimating Cypriot bank losses in their Greek operations at between €7.7bn and €13.1bn. Furthermore he was of the opinion that these losses would not be absorbable through any capital buffers in the banks as these had been exhausted.

In the recent recapitalisation exercise some capital buffers were used to absorb losses, but these are now exhausted, in our opinion. We think that any losses on lendingto Greece will translate to a requirement for additional capital raising requirement pretty much one-to-one (p.6).

In the same report Sterne also estimated that 15% of Cypriot domestic loans were not performing and equalled about €5bn or 28% of Cyprus's GDP. There did not appear to be adequate bank capital provisioning for these NPLs (non performing loans) at the time (see p. 6).

What is remarkable here is that Sterne was calculating a bank recapitalisation figure for Cyprus at a mid-case scenario of around €15bn and eurozone officials were bandying about a €3bn bank recap figure.

The Pimco Report that was never released estimates €7-10bn recap figure

Pimco, the investment group, was commissioned by a committee including Greek-Cypriot officials and the troika of the European Commission, the ECB and the IMF to do an audit of Cyprus's banking sector. It estimated that a a bailout of between €7bn and €10bn would be needed (see Cyprus Mail Psyllides 21 February 2013) to cover the banks' latent losses. This figure was deemed controversial and the report was never officially published (see The Banks).

To: The Money Laundering Audits