With thanks to Joseph Cotterill @jsphctrl at the FT's Alphaville who tweeted the ECB press release and tweeted me the May 2 ECB Decision and thoughts on ELA conversion

The ECB announced (May 2 2013 Decision) that a special ruling has been made that permits Cypriot Government Bonds and other marketable assets to be used once more as collateral against borrowing from the ECB.

The broad implication of this ruling is that the borrowing costs incurred by Cypriot banks in their operations with the ECB or the Central Bank of Cyprus could fall further than implied by the general rate cuts announced by the ECB on the same day.

Given that total ELA (Emergency Liquidity Assistance) bank borrowing from the the CBC is €11.4bn this could be a piece of relatively good news, particularly if it reduces the CBC and government's ultimate liability for the ELA by allowing a conversion to ECB borrowing for which the ECB (and not the CBC/Cypriot Government) is liable.

How does this new dispensation work?

The ECB has allowed Cypriot government bonds and government guaranteed bank bonds to be eligible as collateral for ECB borrowing. In the case of member-states where government bonds are rated below a certain level (junk status) and do not meet ECB collateral eligibility criteria this is only permitted when 'Member States [are] compliant with a European Union/International Monetary Fund programme' - that is at the moment Ireland, Greece and Portugal (see May 2 Decision).

Cyprus is now included because the '[ECB] Governing Council has taken into consideration the Memorandum of Understanding concluded between the Republic of Cyprus and the European Commission and endorsed by the Member States,r eflecting the economic and financial adjustment programme for Cyprus' (2 May ECB Decision p.2).

This eligibility was lost under ECB rules when a third credit rating agency downgraded Cypriot bonds to junk status in June 2012. This had a massive impact because it not only wiped out a part of Cypriot banks' collateral (ie their holdings of Cypriot government bonds) for longer-term borrowing from the ECB but it also meant that Laiki bank could not use as collateral the the €1.8bn bonds bought-up by the Cypriot state in the government rescue of Laiki in June 2012.

Without eligible collateral Cypriot banks could only survive through the use of ELA funding form the Central Bank of Cypurs (see chart in post below) which is charged at higher interest rates than longer-term, eligible-collateral-backed borrowing from the ECB.

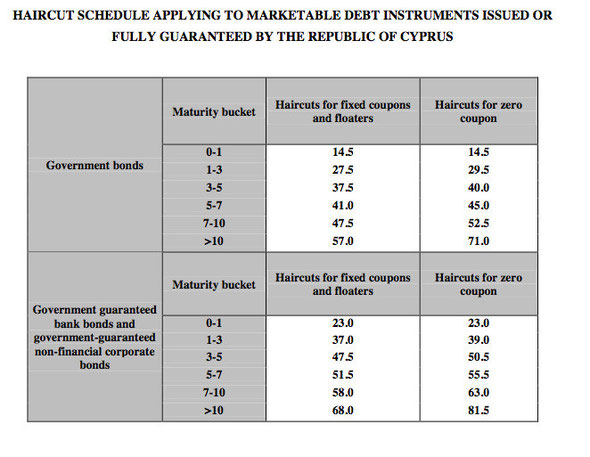

The ECB decision includes the application of applying 'specific haircuts to such instruments different from those provided for in Section 6.4.2 of Annex I to Guideline ECB/2011/14.'

These 'haircuts' are in effect risk-weighted reductions in the newly acceptable collateral's value. A table at the end of the May 2 Decision sets outs these special haircuts.

These vary from a 14.5% market value reduction in the the case of a fixed or floating government bond with a maturity of less than one year to 71% for a zero coupon with a maturity of greater than 10 years. The haircuts are even greater for government guaranteed bank bonds ranging from 23% on less than 1 year to 81.5% on a zero coupon over 10 years (see Table 1 below).

Table 1: Annex from ECB May 2 detailing 'specific haircuts' on market value of government collateral

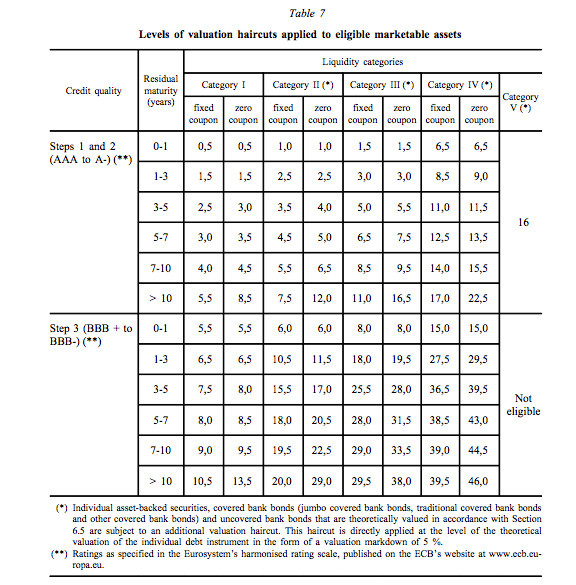

The general rules for special haircuts on marketable assests are set out at 6.4.2 in Annex 1 of the Guideline ECB/2011/14 (see pp 62-6). This explains in point b) that,

'the haircuts are applied by deducting a certain percentage from the market value of the underlying asset.' And it sets out a table of 'valuation haircuts applied to eligible marketable assets'(see Table 2 below).

Table 2: ECB 2011/14 Annex 1 6.4.2. haircut rates on marketable assets

A quick comparison of the haircut rates in ECB 2011/14 and the May 2 Cyprus Decision show that the special haircuts applied in Cyprus appear to much greater than those in the ECB 2011 Guidance.

But a more detailed comparison of say Step 3 credit-rating Category IV fixed coupons against the Cyprus decision haircuts is more revealing (see Table 3 below).

(NB I have taken the Category IV ratings as comparators because these are the maximum 2011/14 haircuts. I do not know if Cyprus debt is rated Category IV or not.)

Table 3: Haircut differrentials between ECB Step 3 credit rating Cat IV fixed coupon and ECB Cyprus May 2 fixed government coupon at different maturities (percentages)

|

Residual Maturity |

ECB 14/2011 haircut (A) |

ECB Cyprus 2 May haircut (B) |

Difference =A-B |

| 0-1 | 15 | 14.5 | 0.5 |

| 1-3 | 27.5 | 27.7 | 0 |

| 3-5 | 36.5 | 37.5 | -1 |

| 5-7 | 38.5 | 41 | -2.5 |

| 7-10 | 39 | 47.5 | -8.5 |

| 10+ | 39.5 | 57 | -17.5 |

Table 3 shows that for the haircut differential between ECB 2011/14 Step 3 credit rating, Category IV government bond fixed coupons and fixed coupons in the Cyprus 2 May ECB Decision is as follows:

- in residual maturity period 0-3 they are the same or the Cyprus haircut is less

- in residual maturity period 3-5 years the differential grows from -1 to -2.5 per cent

- in residual maturity period 7-10+ years the differential grows from -8.5 to -17.5 per cent.

This shows that the haircut differential grows with the residual maturity of the bonds from less than or nothing in the first three years to a whopping -8.5 to -17.5 in residual maturities of more than 7 years.

How do we explain the haircut differential trend with bond residual maturity?

Clearly as residual maturity increases the forecast timeframe becomes longer and risk weighting increases. This is clear in the ECB 2011/14 table where the haircut spread increases from 15 to 39.5%.

However the spread in the Cyprus special haircuts is much greater than in ECB 2011/14 (24.5 percentage points) going from 14.5 to 57 per cent (42.5 percentage points).

One interpretation here then would be that the early haircut differentials are based on a reduced risk-weighting of Cypriot government bonds and government-backed bank debt due to the three year bailout programme and the supervision of Cypriot compliance with the programme as set out in the Memordandum of Understanding.

Beyond the bailout programme a heavier risk weighting is built into the haircuts.

(Or perhaps there is an ammended ECB 14/2011 that has different values in Annex 1 6.4.2 Table 7 although I doubt this as ammendments seems to have been limited - see p.12).

The decision by the ECB has been made possible by the ratification of the Cyprus bailout programme with the Troika by the EU Finance Ministers Group, the Cypriot parliament yesterday and other member state parliaments in April.

As such it hardly represents 'largesse' as the reassigning of eligibility to previously suspended collateral is permissible when member-states are compliant with an EU/IMF programme. However there does appear to be some urgency in the decision.

(Although the completion of the anti-money laundering audit specified in the M of U this week and measures taken in parliament yesterday can also be seen as evidence of 'compliance with the EU/IMF programme').

Quite what the cost implications are for Cypriot bank ECB borrowing costs is another matter.

A common sense interpretation (ie relatively uniformed with regard to the intricacies of ECB Eurosystem bank lending) could suggest that for banks with a considerable increase in eligible collateral (Cypriot bank holdings of Cypriot government bonds and government-backed bank bonds) it could be possible to convert some expensive Emergency Liquidity Assistance borrowing (totalling €11.4bn) to cheaper longer-term ECB Main Refinancing Operations.

The ECB rate cuts for May 2 2013 wer:

-

Main Refinancing Operations of the Eurosystem cut by 25 basis points from 0.75% to 0.50%

-

Marginal Lending Facility cut by 50 basis points from 1.50% to 1.00%.

No one seems to know the exact interest charged on ELA.

Reuters published a Factbox on ELA in March 2013 that reported that average interest rate charged on it is 'estimated to be around 100 to 150 basis points above the ECB's overnight lending rate.'

FT Alphaville 2 May 2013 says that for ELA "you get the M[arginal] L[ending] F[acility] rate plus a 'penalty' reflecting the emergency nature of the aid."

If we take the ELA interest rate difference with the ECB's Main Refinancing Operations at 75 basis points (0.75%) for sake of argument a shift from ELA to MRO would represent a saving on a one billion euro loan of €7.5m a year.

However, it nededs to be rememembered that for every amount of now-eligible collateral that could effect a shift from ELA to MRO a considerable haircut will be made in its eligible

collateral value (see Table 1 above).

Lastly, a great benefit of shifting Cypriot bank loans from ELA to MRO funding is that the liability for the loan shifts from the Central Bank of Cyprus, and ultimately the Cypriot government, to the ECB.

Write a comment

Inter (Saturday, 08 March 2014 19:50)

Thank you. Very informational and simple for people who don't know much about the subject.