Blipfuture: CIC-starting community ownership.

Here are some initial comments and information drawn from the Blipfuture Business Plan and Articles of Association which I have only had sight of in the last few hours. To see these important documents go to the https://www.blipfuture.com site and register as a potential investor. It is free and there is no commitment of any sort.

In October 2015 the current owners of the Polaroid Blipfoto social media site contacted members of the community with a view to offering to sell the company into community ownership.

Since that time and through a consultation with a ‘large number’ of Blipfoto users a small core team of four was formed to take forward negotiations with the owners of the Polaroid Blipfoto site, establish a Community Interest Company, Blipfuture CIC, and to run the company for the first year.

The Business Plan 4.4.2 states, The team was brought together by the current owners through Joe Tree (founder of Blipfoto).’ The team are Annie Andrews, Graham Colling, Bob Hamilton and Ian Stevenson.

It is proposed that the CIC will be 100% owned by its voting shareholders and that other non-voting shares will be used in part-payment for the assets of Blipfoto.

It is unclear if all current Blipfoto members will be able to hold shares given different national jurisdictions on shareholding. Currently shares will only be available to citizens of the European Union, the European Economic Area and Switzerland.

(Blipfoto has considerable membership in the USA, New Zealand, Australia and South Africa amongst other locations outside these organisations.) Donations are possible from any country but obviously this does not confer voting share ownership.

Joe Tree and Graham Maclachlan, the original founders of Blipfoto Ltd are supporting this initiative and helping the Blipfuture team during the transition.

The controversial branding link-up with Polaroid will end.

Financial sustainability will be via subscriptions.

Blipfoto is currently owned by private investors, Jeff Hecktman and Bobby Sager. The Blipfuture Business Plan 3.3 states,

‘They [the current owners] have been very flexible in offering to take payment in a combination of cash, non-voting shares in the new company and long term payments which are only made when and if the company generates a surplus’.

It may also be possible for commercial partners who have worked with Blipfoto to invest in Blipfuture so long as this does not damage either the values of Blipfoto or the concept of community ownership.

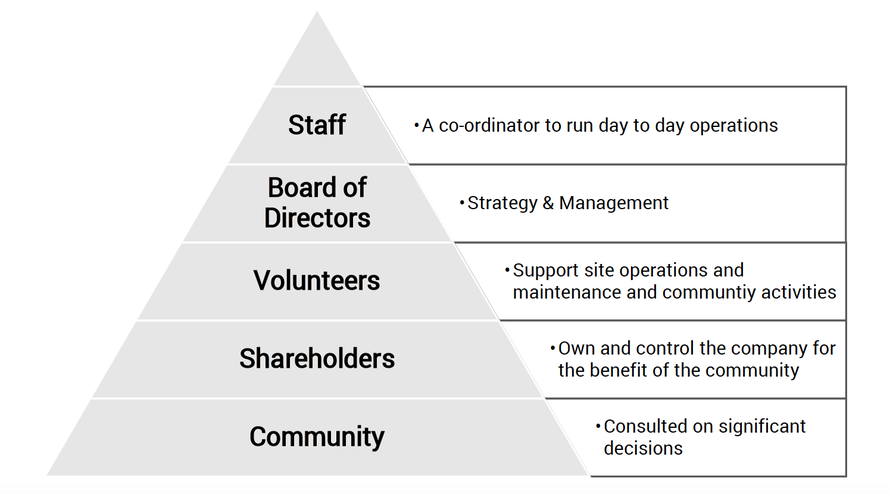

The company will be run by staff – currently the Business Plan names only a ‘co-ordinator’ - and managed by a Board of Directors. Volunteers will be encouraged to support the website operations and maintenance and develop community activities. Shareholders (one vote per shareholder not per share) will own and control the company. The broader Blipfuture community of members will be consulted on significant decisions.

It's important to emphasis that a Community Interest Company has to do what it says on the tin. It can’t just pay lip service to community members that are not also shareholders.

Indeed its an annual report a CIC has to justify to the CIC Regulator it is consuling and serving it community.

Shareholders will exercise control through resolutions at general meetings and via written resolutions and will appoint and remove directors.

Of particular interest and importance is the fact that there will be one vote per shareholder rather than one vote per voting share. That is, no matter how many voting shares an individual holds they will only have one vote. The Business Plan 4.2 states that this is so that, ‘everyone who invested in the company has an equal say.’

This is correct in as much investors are those that buy shares but it rather neglects the position of donations from members who cannot hold shares because they do not live in the EU, EEA or Switzerland.

The company aims to raise at least £180,000 through crowdfunding using the company InShare to do this.

In Year 1 of operation the company projects sales revenue of £57,000. This jumps to £110,000 in Year 2 and then grows moderately to £131,000 in Year 5. Gross Profits are projected at 79% for Year 1 rising to 89/90% in subsequent years.

As a CIC neither gross nor net profits will be distributed and will be ploughed back into the company. In exceptional circumstances a dividend could be paid on shares but this is capped by the CIC regulator at 35% of profits.

Under CIC structures Directors can be remunerated/paid (unlike Charitable organisations) but no mention is made payments to directors in the Business Plan and it must be assumed that they are giving their time voluntarily.

TheArticles of Association (25) state in what I assume is a standard clause that Directors are entitled, subject to the Articles and in particular Article 3, ‘to such remuneration as the Directors determine.’

Again, no heading is shown for Director’s remuneration in the Business Plan and it must be assumed that the Directors will not be determining remuneration for themselves.

Continued community ownership of the company is guaranteed both by the CIC structure and CIC Regulator and by the ‘objects’ of the company as set out in the Articles of Association. These include an object which, ‘which state[s that Blipfuture] is to be run on a not-for-profit basis for the benefit of the Blipfoto community.’ Theoretically the objects could be changed by a shareholder vote but this change would need to be approved by the CIC Regulator.

There is a very useful section on risks. Raising the initial £180,000 for the purchase of the Blipfoto assets is considered to be a medium risk with a low impact on investors (if the crowdfunding fails investors are not debited their committed payment) and a high impact on the Blipfoto community in that the site is likely to be closed down.

The detailed contract to purchase Blipfoto has not been finalized but failure to complete is considered a low risk – again with a high impact in that closure could be likely.

Low membership take-up – in terms of paying members – could be an issue. It was low membership growth (paying and non) that caused investors to cancel further investment and sink Blipfoto Ltd in March of this year. This is considered to be a low risk with a high impact.

Unfortunately, if understandably (Blipfuture may not have access yet to commercially sensitive Blipfoto data) they are no figures for current or future membership or subscription charges. To raise £400,000 from say a membership of 5,000 would require an £80 investment or donation on average.

On the other hand, the crowdfunding campaign is not aimed at investors expecting a financial return but rather at community members who want to save and sustain their community. This does require a leap of faith but there is protection, as I understand it, in as much if the crowdfunding does not reach its target no money will be taken from investors.

There is a brief survey of competitors with Project 365 at the top. And a graphic showing that Blipfoto occupiers a unique position in the photosharing world in that it is contrained (one photo a day) and based on photo saving rather than photosharing. The lack of a key or explanation does not make this graphic easy to understand and I am unclear if Project 365 is shown on it.

The potential closeness of Project 365 to Blipfoto/Blipfuture is a strategic issue that may need further consideration.

The Business Plan does not state where Blipfoto’s management and day-to-day activities will be located but I assume it will be in Edinburgh. This does have some bearing on volunteering activities but much of this will also be conducted at a virtual level.

Location could also be a consideration for General Meetings at which shareholders vote by a show of hands. It seems proxies (Articles 56 and 57) could be used but votes will be on the basis of one vote per attendee (ie a proxy could not represent say 20 votes from Finland with the right to vote 20 times (see Articles 53). Written resolutions can be voted on via a postal ballot (Articles 59).

Polls on a resolution may also be called (Articles 54) but these do not appear to be postal polls but rather ones conducted before or at a General Meeting.

Minutes (Articles 62) are to be kept but there is no stipulation to send copies of them to shareholders.

There are two types of shares – Ordinary and A Ordinary. Only Ordinary shares have a voting right. Both are priced at £10. Votes are limited to one per shareholder present (or by proxy) on a show of hands at a General Meeting.

There is an issue that will need to be dealt with concerning user representation. Within the Articles of Association the only users who have representation are those holding an Ordinary Share or shares who can either attend a meeting or arrange for a proxy to attend a meeting (a fairly complex procedure). This is different for written resolutions that can be dealt with through a postal ballot (although this clearly has major administrative costs attached to it).

The Blipfuture community (if anything like the Blipfoto one) could be scattered geographically across seven continents and 150 countries. Members residing outside the EU, EEA and Switzerland cannot hold shares. And those who do hold shares would normally be expected to represent themselves physically at General Meetings or arrange for a proxy to attend.

There is a danger here that a significant part of the community is prohibited from owning voting shares and those that can own them experience considerable difficulty in attending General Meetings.

Given these difficulties, every effort must be taken to stop Blipfuture becoming or becoming seen to be a community that by necessity needs to situated near the seat of the company which is presumably Edinburgh.

For background on the Blipfoto story see blog entry below this one and seven more posts here.